Web Development & Digital Strategy Insights: How Skylooper Drives Scalable Growth

Unlock the secrets to scalable online growth with expert web development and digital strategy ins...

Read more →

Win bank and credit union contracts with a lender-ready plan built for professional recovery operations. Whether you’re a solo agent or scaling a multi-truck fleet, this template shows how to price assignments, manage risk, and standardize field protocols.

Reference tools and workflows lenders recognize: DRN/Vigilant LPR patrols, Clearplan & RDN assignment handling, TLOxp/CLEAR skip tracing, and Jerr-Dan/Miller underlift equipment. The plan maps intake → locate → recover → release with evidence and chain-of-custody steps.

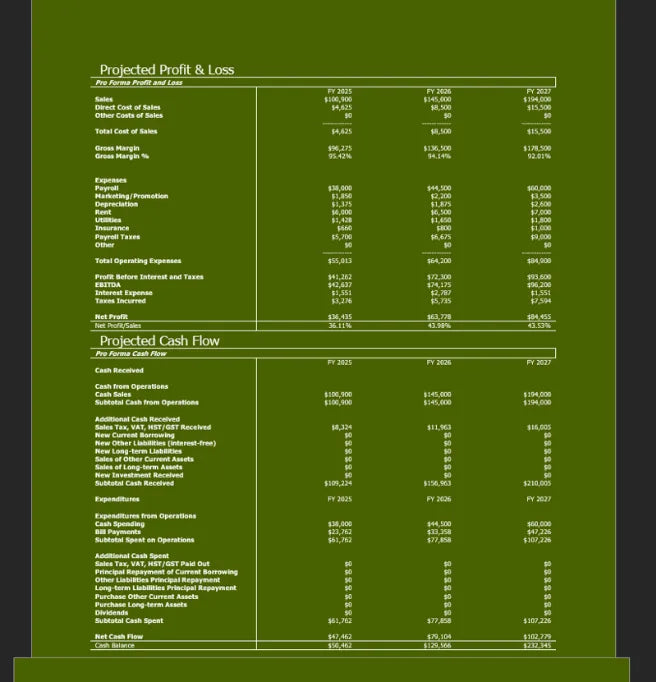

Delivered instantly in Word/PDF and fully editable, it’s SBA-aligned with a complete 3-year forecast. Model recoveries per month, storage and administrative fees, utilization per truck, and DSCR for equipment financing.

Customizable, professional, and built to save you $700+ in consulting fees—so you can pitch lenders and onboard clients faster.

BPlanMaker specializes in U.S. service-business plans used with SBA lenders and bank underwriters. Each template follows a consistent editorial standard: transparent assumptions, documented workflows, and conservative forecasts aligned to lender expectations.

Quick Answer: This repossession company business plan is SBA-aligned and investor-ready. Edit the Word/PDF file, add your territory, trucks, LPR strategy, and storage SOPs, then export a lender-ready PDF with a 3-year forecast and DSCR.

Repossession work is state-regulated and contract-driven. The plan helps you document:

Templates are educational business documents, not legal or tax advice. Confirm state requirements with counsel and your insurer.

– Independent agents launching their first company

– Licensed recovery specialists seeking SBA/equipment financing

– Towing firms expanding into asset recovery and storage

– Security/field services adding collateral retrieval

– Regional fleets standardizing compliance and SOPs

Funding credibility, faster setup, lower costs. This template saves you $700+ in consultant fees, downloads instantly, and is SBA/investor-ready. It includes CARS-style training cues, evidence documentation, LPR ROI modeling, and release/storage workflows—so lenders and clients see a compliant, scalable operation from day one.

Typical income blends recovery fees, storage/admin, transport, and remarketing add-ons. The model estimates break-even by trucks, shifts, and recovery rate. Adjust patrol hours, capture rates, fuel, and insurance to test DSCR before you finance equipment.

Follow a lender-first outline: compliance proofs, LPR tactics, assignment SLAs, storage SOPs, and a 3-year forecast tied to recoveries per truck. Export a clean PDF for lenders and forwarders.

Use DRN/Vigilant for LPR, Clearplan/RDN for assignments, and TLOxp/CLEAR for skip. Add photo evidence, timestamped logs, and auditable release forms to protect clients and reduce disputes.

Auto credit stayed elevated through 2025 as lenders tracked delinquencies and assignment volume. New originations were strong, and total auto balances remained high. Trade coverage reported multi-year highs in subprime late pays during 2024–2025, supporting assignment flow. Recovery operators that pair strict compliance with timely updates remain preferred partners for banks and credit unions.

Sources: Federal Reserve Bank of New York — Household Debt & Credit (Aug 2025); Auto Finance News — Repossessions & Assignment Pace (June 2025).

Every week you wait, competitors grab lender relationships and early assignments. This template saves $700+ in consulting fees and gets you lender-ready fast.

Start with a data-driven, funding-friendly plan banks trust — download, edit, and launch today.

Buy Now & Download Instantly – Start Your Repo ServiceVersion: v1.00 • Update cadence: reviewed quarterly for accuracy

Questions before buying? Email email@bplanmaker.com — we respond fast.

Last updated: October 2025 by BPlanMaker.

Templates are educational business documents, not legal or tax advice.

BPlanMaker

Still researching your plan? Explore our latest articles on writing a stronger business plan, using your business plan template, and getting ready for lenders, investors, and SBA programs.

Unlock the secrets to scalable online growth with expert web development and digital strategy ins...

Read more →

Access the official 2025-2026 list of the Top 25 SBA 7(a) Lenders ranked by loan volume. Discover...

Read more →

Stop wasting months on complex financial modeling. Learn the exact process for calculating startu...

Read more →Take the next step toward a fully fundable business plan template with these helpful resources:

Launching a business is hard — but writing a fundable plan doesn’t have to be. Our business plan templates are built from real-world plans that helped U.S. entrepreneurs secure funding from banks, SBA lenders, and investors.

Secure Shopify checkout — your files are delivered instantly after purchase.